Credit that rewards your discipline

Urban Indians are disciplined in real life - waking up on time, following rules, staying fit, paying bills on time. Yet, you are invisible to traditional credit models. DisciPay turns your verified routines and habits into a trusted financial profile.With AI-backed behavioural scoring, get credit access based on your everyday habits with approvals in less than 60 minutes!

Built for the disciplined generationTM

Why DisciPay exists

Why should your discipline count only in life and not in finance?

Most of us are way more disciplined in real life than our credit score makes it look. You wake up on time, get your steps in, hit your workouts, follow traffic rules, keep your phone clean, pay your bills before they’re due. But, none of that actually counts anywhere. At least not with traditional lenders.That’s exactly why we built DisciPay.Instead of judging you only by your credit history, DisciPay looks at the discipline you already have in your daily life.

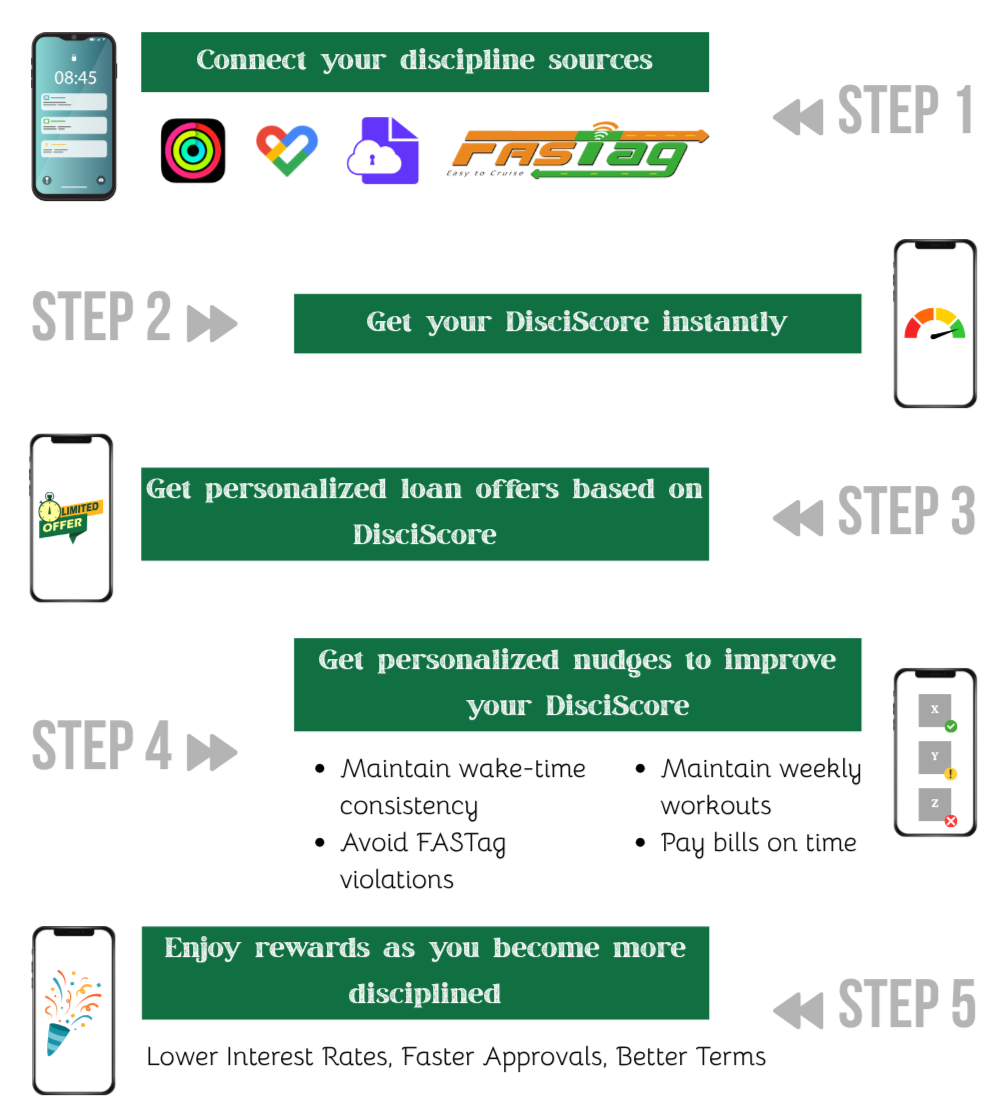

Things like your fitness streaks (Apple Fitness, Google Fit, Garmin, Strava, Samsung Health), whether you follow traffic rules (FASTag + challan history), and even how regularly you pay your bills (UPI payments, DigiLocker records).And don’t worry, it’s all shared only if you choose to.You stay in control the whole time.It’s credit that finally sees the real you.

What early users say about discipay

Ananya, 25

(Advertising Professional)"I don’t have a long credit history, but I have a strong routine. DisciPay used my fitness consistency + clean FASTag record to approve my loan in under an hour!"

Raghav, 38

(Tech Consultant)"This is the first time a financial product valued my discipline - no challans, consistent workouts, and timely bill payments. Finally something fair for people who live responsibly."

Sana, 22

(Designer)"I connected Apple Fitness, Strava, DigiLocker, and DisciPay showed exactly how my habits improved my score. This made me trust the system instantly and has become a go-to."

users from

Urban India shows high real-life discipline but low credit visibility.

DisciPay bridges the gap

Your daily discipline → Your DisciScore → Your loan terms

| Category | BEFORE DISCIPAY (Traditional Lenders) | AFTER DISCIPAY (Behaviour+AI Powered Credit) |

|---|---|---|

| Primary Basis for Credit | Only credit history / bureau score | Verified behaviour + habits + digital discipline |

| Treatment of Thin-File Users | Thin-file users = high risk | Step + workout discipline (Garmin, Fitbit, Strava) |

| Payment Reliability | Only EMI/Credit Card tracked | UPI bill timeliness, recurring payments, subscription stability |

| Ability to Improve Score | Hard, slow, opaque | Behaviour-nudges help increase DisciScore quickly |

| Relevance to Urban Millennials | Outdated, credit-history dependent | Built for 21–45 urban users with digitally trackable routines |

| Rule-Following Behaviour | Not captured | FASTag integrity + 0 challans = positive scoring |

| Fitness & Routine Signals | Completely ignored | Uses Apple Fitness, Google Fit, Samsung Health for wake-time consistency, sleep patterns |

Fair pricing that rewards your discipline & not your loan history

Traditional NBFC Experience

Profile:

27 years old, lives in Bangalore

First-jobber, no past loans (thin-file)

Monthly salary: ₹55,000Clean traffic record, consistent workouts, pays bills on timeNBFC View:

Credit Score: NA / Thin-file

Automatically treated as high riskNBFC Loan Offer:

Interest rate: 18%–24% p.a.

Processing fee: ₹1,000+Approval time:

24–48 hoursReason:

“Insufficient credit history”Problem:

His discipline in real life doesn’t matter. Pricing is inflated just because he’s new to credit.

DisciPay Experience (Same Person)

Behaviour Signals:

Consistent 7am wake-up (Apple Fitness)

5 workouts per week (Google Fit + Strava)

Zero traffic challans (Parivahan)

FASTag clean (no violations)

12-month on-time UPI bill payments

Clean device hygieneDisciScore: 784

(This is considered “High Discipline”)DisciPay Loan Offer:

Interest rate: 10%–12% p.a. (6–12% cheaper than NBFC)

Processing fee: ₹0–200 (behaviour waiver)

Approval time: < 60 minutesReason:

“Verified high discipline & low behavioural risk”Savings vs traditional lender:On a ₹1,00,000 loan for 12 months:

At 20% NBFC rate → ₹11,000 interest

At 11% DisciPay rate → ₹5,900 interestUser saves: ₹5,100, by just being disciplined.

how to get your disciscore?

© 2025 DisciPay - India’s first behaviour-powered credit engine.